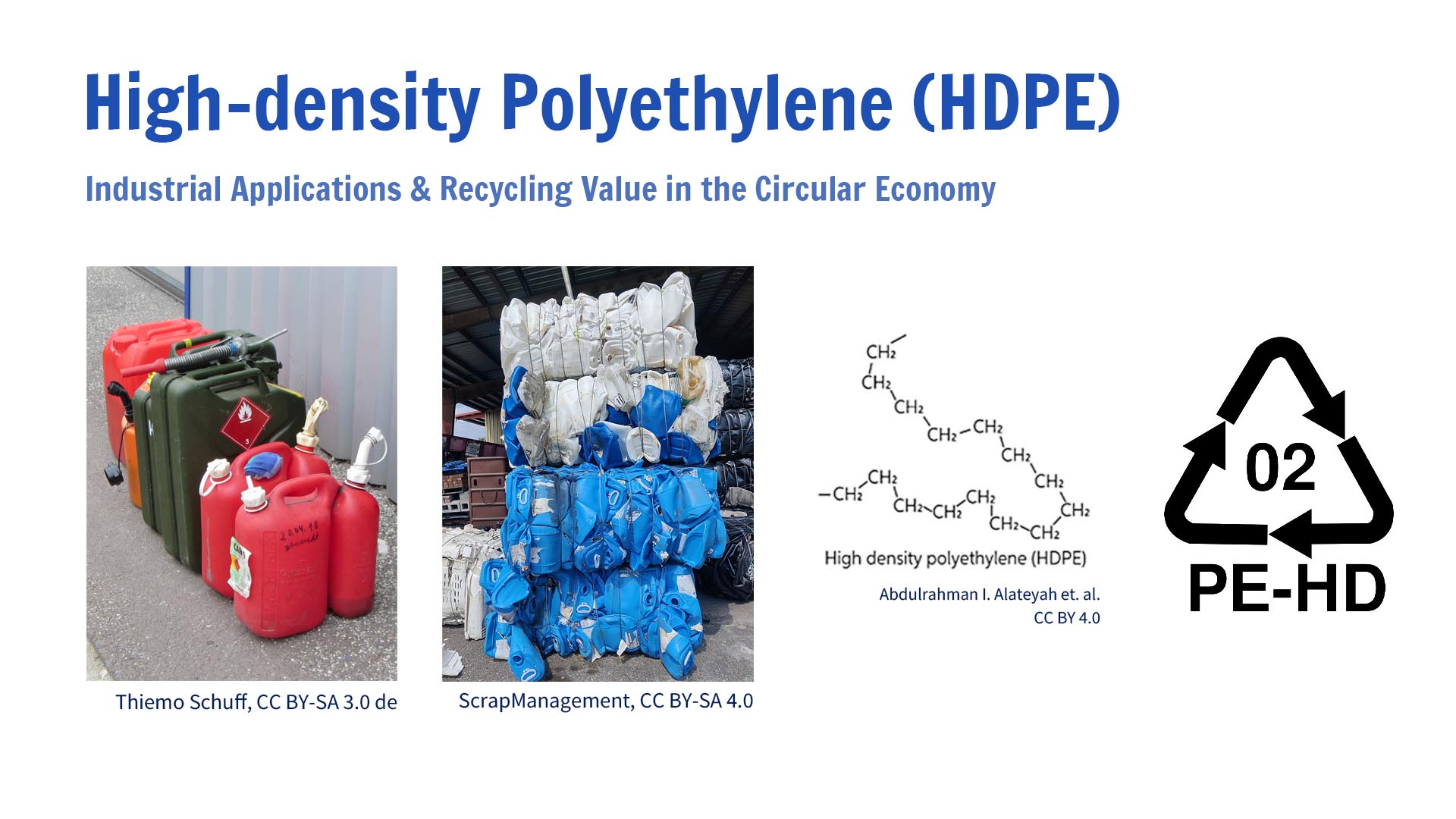

High-Density Polyethylene (HDPE) has established itself as the workhorse of the plastics industry through a unique combination of molecular structure and performance characteristics. Its linear polymer chains pack tightly to create a material that outperforms other polyethylenes in rigorous applications while maintaining excellent processability. This structural advantage has propelled HDPE to a $120 billion global market, growing at 4.5% annually as it replaces traditional materials in demanding environments.

The secret behind HDPE's superiority lies in its high crystallinity (70-80%) achieved through linear molecular chains. Unlike the branched architecture of LDPE that limits packing efficiency, HDPE's straight chains align into tightly packed crystalline regions, yielding a higher density (0.95g/cm³ vs 0.92g/cm³) and remarkable mechanical properties. This crystalline structure delivers 28MPa tensile strength - 40% greater than LDPE - while maintaining ductility. The material's temperature resilience spans from cryogenic conditions (-50°C) to the boiling point of water (120°C), outperforming most commodity plastics.

Advanced polymerization techniques like Ziegler-Natta catalysis allow precise control over HDPE's molecular weight distribution. Bimodal HDPE grades combine long chains for environmental stress crack resistance with short chains for processability, achieving pipe-grade materials that withstand 100-year service lifetimes. Modern metallocene catalysts now produce HDPE with exceptionally narrow molecular weight distributions, reducing warpage in large injection-molded parts by up to 60% compared to conventional grades.

HDPE reigns supreme in chemical resistance applications, withstanding concentrated acids, bases, and solvents that dissolve other plastics. This capability stems from its non-polar, saturated hydrocarbon structure that resists chemical attack. Regulations in the EU and North America mandate HDPE for pesticide containers and industrial chemical packaging, where its stress crack resistance prevents catastrophic failures. Laboratory tests show HDPE maintains integrity after 10,000 hours of exposure to 37% hydrochloric acid - a performance unmatched by alternative polymers.

The global HDPE market distribution reflects its versatile dominance: piping systems capture 45% of production for water and gas distribution, leveraging the material's fatigue resistance and leak-proof jointing capabilities. Consumer packaging accounts for 30%, particularly for detergent bottles and personal care products requiring stiffness and squeezeability. Automotive fuel tanks represent 15% of demand, where HDPE's permeability to hydrocarbons is 100 times lower than competing materials. Emerging applications like 3D-printed marine docks and modular construction panels are driving additional growth in the engineering sector.

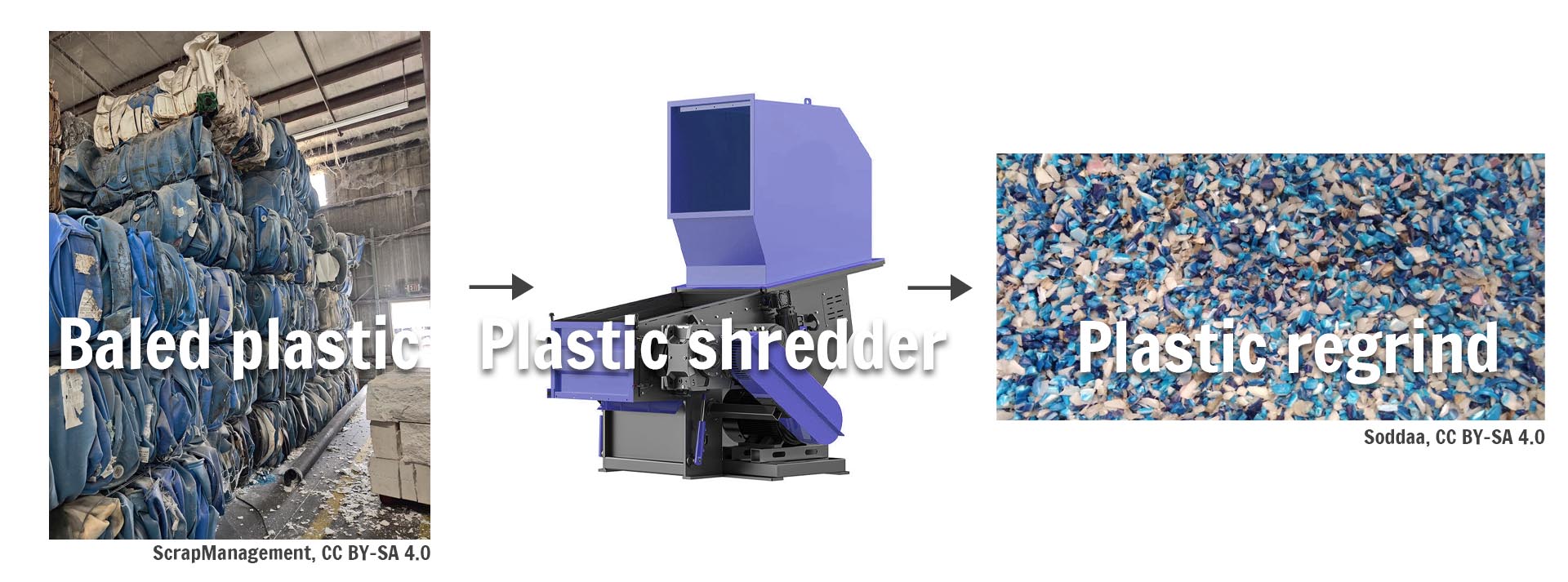

HDPE Recycling Chain's Game Changer: Shredder Systems

In the HDPE recycling ecosystem, shredders have evolved from simple size-reduction machines into sophisticated material preparation hubs that address the polymer's unique recycling challenges. Modern shredding systems now incorporate multiple stages of processing and purification, transforming contaminated post-consumer HDPE into high-value regrind that competes with virgin material. These technological leaps have made HDPE one of the most successfully recycled polymers, with food-grade recovery rates exceeding 85% in advanced systems.

Plastic Shredder Applications in HDPE Recycling

HDPE-specific shredders feature heavy-duty cutting chambers designed to handle the material's toughness and flexibility. Unlike PET shredders that prioritize clean cuts, HDPE systems utilize tearing and shearing mechanisms to process bulky items like crates and pipes without wrapping. The latest generation incorporates variable-speed rotors that adjust torque based on load detection, reducing energy consumption by 25% when processing thin-walled containers. Water-cooled bearings extend operational life when processing abrasive materials like pesticide containers that may contain mineral residues.

Solutions for Metal Contaminants

Dual-shaft metal shredder paired with eddy current separators form the gold standard for processing metal-contaminated HDPE streams. The initial shredding stage reduces whole bottles with aluminum caps to 50mm flakes, liberating metal components for subsequent separation. Advanced systems like the STEINERT UME combine multiple separation technologies - magnetic drums remove ferrous metals while eddy currents eject aluminum with 99.7% efficiency. German recyclers report recovering 1.5kg of aluminum per ton of HDPE processed, creating an additional revenue stream that offsets operational costs.

Advanced Purification Technologies

Electrostatic separators have become critical for achieving food-grade HDPE purity. Triboelectric systems charge flakes through friction, then deflect metal traces using high-voltage plates - a process that removes particles as small as 50 microns. When combined with metal-detection checkweighers, these systems achieve 99.9% metal-free output required for sensitive applications like food packaging. The technology has enabled recycled HDPE to meet FDA 21 CFR compliance for direct food contact, a milestone previously thought unattainable for post-consumer material.

Melt filtration innovations have specifically addressed challenges in HDPE film recycling. Self-cleaving screen changers with 150-micron openings now process flexible packaging without clogging, while some systems incorporate laser-perforated filter discs that withstand 400 bar pressure. A breakthrough Austrian design uses rotating filter surfaces that continuously renew themselves, achieving 5,000 operation hours between maintenance intervals - ten times longer than conventional systems. These advancements have made recycled HDPE film competitive with virgin material in demanding applications like geomembranes and pond liners.

HDPE Recycling Chain's Game Changer: Shredder Systems

In the HDPE recycling ecosystem, shredders have evolved from simple size-reduction machines into sophisticated material preparation hubs that address the polymer's unique recycling challenges. Modern shredding systems now incorporate multiple stages of processing and purification, transforming contaminated post-consumer HDPE into high-value regrind that competes with virgin material. These technological leaps have made HDPE one of the most successfully recycled polymers, with food-grade recovery rates exceeding 85% in advanced systems.

Plastic Shredder Applications in HDPE Recycling

HDPE-specific shredders feature heavy-duty cutting chambers designed to handle the material's toughness and flexibility. Unlike PET shredders that prioritize clean cuts, HDPE systems utilize tearing and shearing mechanisms to process bulky items like crates and pipes without wrapping. The latest generation incorporates variable-speed rotors that adjust torque based on load detection, reducing energy consumption by 25% when processing thin-walled containers. Water-cooled bearings extend operational life when processing abrasive materials like pesticide containers that may contain mineral residues.

Solutions for Metal Contaminants

Dual-shaft shredders paired with eddy current separators form the gold standard for processing metal-contaminated HDPE streams. The initial shredding stage reduces whole bottles with aluminum caps to 50mm flakes, liberating metal components for subsequent separation. Advanced systems like the STEINERT UME combine multiple separation technologies - magnetic drums remove ferrous metals while eddy currents eject aluminum with 99.7% efficiency. German recyclers report recovering 1.5kg of aluminum per ton of HDPE processed, creating an additional revenue stream that offsets operational costs.

Advanced Purification Technologies

Electrostatic separators have become critical for achieving food-grade HDPE purity. Triboelectric systems charge flakes through friction, then deflect metal traces using high-voltage plates - a process that removes particles as small as 50 microns. When combined with metal-detection checkweighers, these systems achieve 99.9% metal-free output required for sensitive applications like food packaging. The technology has enabled recycled HDPE to meet FDA 21 CFR compliance for direct food contact, a milestone previously thought unattainable for post-consumer material.

Melt filtration innovations have specifically addressed challenges in HDPE film recycling. Self-cleaving screen changers with 150-micron openings now process flexible packaging without clogging, while some systems incorporate laser-perforated filter discs that withstand 400 bar pressure. A breakthrough Austrian design uses rotating filter surfaces that continuously renew themselves, achieving 5,000 operation hours between maintenance intervals - ten times longer than conventional systems. These advancements have made recycled HDPE film competitive with virgin material in demanding applications like geomembranes and pond liners.

The Value Leap of Recycled HDPE

The recycled HDPE market has undergone a remarkable transformation from low-value commodity to premium engineered material. Advanced processing techniques and innovative compound formulations now position rHDPE as a high-performance alternative to virgin polymers across demanding applications. This value elevation reflects both technological maturation and growing recognition of circular economy principles in material specification.

From Waste Bottles to Premium Building Materials

Some company has pioneered high-value applications for post-consumer HDPE through their formulation. By combining 95% recycled HDPE with 5% wood flour and proprietary additives, they've created decking material that outperforms conventional wood-plastic composites. The material demonstrates 3x greater weatherability than virgin HDPE in accelerated UV testing, maintaining structural integrity after 5,000 hours of exposure. The product commands a 20% price premium over conventional decking while diverting 180 million milk jugs annually from landfills.

Further enhancing performance, the latest generation incorporates nano-clay additives that improve stiffness by 40% without sacrificing impact resistance. Architectural applications now include exterior cladding systems that meet Class A fire ratings - a breakthrough for recycled plastic building materials. The compound's thermal expansion rate matches that of aluminum, enabling reliable integration with metal framing systems in large-scale installations.

Automotive Industry's Sustainable Alternative

Some motor company has implemented recycled HDPE in structural battery components for their electric vehicle lineup. Their specially formulated rHDPE blend reduces tray weight by 15% compared to virgin alternatives while meeting stringent flame retardancy standards (UL94 V-0). The material undergoes extensive purification to ensure dielectric properties remain stable across -40°C to 85°C operating ranges. This application alone utilizes 8,000 tons annually of post-consumer HDPE, primarily sourced from detergent bottle recycling streams.

The automotive sector has also pioneered closed-loop HDPE systems. "Bumper-to-Bumper" program recovers end-of-life vehicle plastic components for reprocessing into new automotive parts. Through advanced compatibilizer technology, they successfully reintegrate 30% recycled content into new bumpers without compromising crash performance. The process involves precision shredding to 6-8mm flakes followed by spectroscopic sorting to eliminate paint contamination. This initiative has reduced CO2 emissions by 12,000 tons annually across their European operations while establishing a blueprint for circular material flows in transportation manufacturing.

The Golden Decade Ahead for HDPE

The coming ten years will witness HDPE's transformation from a commodity plastic to a circular economy superstar, driven by revolutionary recycling technologies and radical design thinking. Two parallel developments - advanced chemical processing and consumer-focused innovation - are converging to create unprecedented opportunities for sustainable material systems. This dual transformation promises to redefine HDPE's role in the global plastics economy.

The Disruptive Power of Chemical Recycling

Pyrolysis and gasification technologies have matured to efficiently convert post-consumer HDPE back to virgin-grade feedstock. Modern catalytic pyrolysis systems now achieve 85% yield of BTX (benzene, toluene, xylene) aromatics at 450°C, which polymerization plants can directly transform into new HDPE with identical properties to fossil-based material. Life cycle assessments confirm these advanced chemical recycling pathways generate just 1.2kg CO2 per kg of HDPE processed - a 42% reduction compared to mechanical recycling's carbon footprint. Dow Chemical's new 50,000-ton facility in the Netherlands demonstrates this technology's commercial viability, producing food-contact approved HDPE from mixed plastic waste.

The process has evolved beyond simple thermal cracking. Microwave-assisted pyrolysis now delivers precise energy input that minimizes char formation, while hydrothermal liquefaction using supercritical water shows promise for processing contaminated HDPE streams. BASF's ChemCycling™ project has successfully incorporated pyrolysis oil into their steam cracker feed, maintaining product quality while displacing 30% of fossil feedstock. These technologies are particularly valuable for heavily pigmented or multi-layer HDPE that challenge mechanical recycling systems.

Consumer-Focused Revolution

"Circular Design Protocol" for HDPE packaging exemplifies the industry's shift toward recyclability-first product development. By eliminating all metal components (including tamper-evident bands and spray mechanisms) and standardizing pigments, they've increased HDPE bottle recycling yields by 28%. Their "Monopolymer Challenge" initiative has redesigned 120 SKUs to use 99.9% pure HDPE, reducing sorting complexity. Early results show these design changes enable closed-loop recycling with just three processing steps instead of the traditional seven.

In emerging markets, distributed recycling models are leapfrogging traditional infrastructure. Kenya's "Solar Shredder Kiosks" combine photovoltaic-powered shredders with mobile payment systems, allowing informal waste collectors to process HDPE on-site. These containerized units produce standardized flakes that command 35% higher prices than baled waste, while reducing transportation emissions by 60%. Each kiosk serves a 15km radius, processing 300kg/day and creating local jobs. The model has attracted $20 million in impact investment for expansion across East Africa, demonstrating how appropriate technology can transform recycling economics in developing regions.

Practical Guide: Maximizing HDPE Recycling Value

Unlocking the full potential of HDPE recycling requires precision at every stage - from initial sorting to advanced processing. This operational blueprint details proven methodologies for both frontline workers and corporate decision-makers to enhance material quality, comply with regulations, and capture maximum economic value from recycled HDPE streams.

Essential Rules for Sortation Professionals

Mastering resin identification goes beyond recognizing the #2 symbol. Experienced sorters utilize density differentiation - HDPE (0.95g/cm³) sinks in specific gravity solutions where polypropylene (0.90g/cm³) floats. Advanced facilities employ calibrated ethanol-water mixtures for rapid field testing. The most valuable HDPE streams exhibit specific characteristics: natural translucent milk jugs command premium pricing, while colored detergent bottles require separate aggregation. Pigmented HDPE must be further sorted by shade depth - light pigments maintain higher value for reprocessing.

Certain contaminants render HDPE completely unrecyclable through conventional channels. Agricultural containers with pesticide residues exceeding 500ppm require specialized detoxification. Medical waste like IV bags triggers immediate quarantine under OSHA regulations. Modern material recovery facilities now implement X-ray fluorescence (XRF) guns that detect halogenated compounds from flame retardants - a growing concern in electronics packaging. The industry's "Three Strikes" rule automatically downgrades loads containing over 3% prohibited contaminants.

Corporate Value Optimization Strategies

Forward-thinking recyclers are investing in AI-powered sorting lines that combine neural networks with hyperspectral imaging. These systems achieve 99.7% purity for food-grade rHDPE by analyzing molecular fingerprints beyond visible spectrum. A recent ROI analysis showed such systems pay back in 18 months through increased yields and reduced labor costs. The latest "Smart Glasses" technology assists human sorters with real-time material identification, boosting individual productivity by 40% while capturing valuable sorting data for process optimization.

Participation in Extended Producer Responsibility (EPR) programs delivers compounded financial benefits. In California's Plastic Recycling Program, certified processors receive $0.12/lb premium for verified rHDPE content. The EU's Circular Plastics Alliance offers additional carbon credits worth €80/ton for documented virgin plastic displacement. Leading corporations like Veolia now employ dedicated EPR strategists to navigate these programs, reporting 15-22% margin improvements on recycled resin sales. Third-party certification under US EPA's Comprehensive Procurement Guidelines further enhances marketability, often justifying 8-10% price premiums for qualified materials.