Procuring an industrial shredder is a significant capital investment that requires thorough financial justification. This analysis moves beyond technical specifications to provide a robust framework for evaluating the economic viability of such an investment. We will guide you through a step-by-step process to quantify the core financial benefits, including drastic reductions in waste disposal fees, the generation of new revenue streams from recycled materials, and gains in operational efficiency. By contrasting these benefits with the total investment and operational costs, you will be equipped to calculate key financial metrics like the Payback Period and Return on Investment (ROI), building a compelling business case.

Deconstructing the Cost Structure of a Shredder Investment: From CAPEX to OPEX

A comprehensive understanding of all costs involved, both upfront and ongoing, is the foundation of an accurate financial analysis. Overlooking any element can lead to an unrealistic projection of the investment's profitability and strain operational budgets down the line.

Initial Capital Expenditure (CAPEX): Procurement, Transport, Installation, and Foundation

The purchase price of the shredder itself is just the beginning. CAPEX must also include the cost of transporting the heavy machinery to the site, which can be substantial for large units. Installation involves crane or rigging services to place the machine. Often, site preparation is needed, such as pouring a reinforced concrete foundation. Furthermore, electrical work to provide adequate power, which may require a new substation or cabling, is a significant and frequently underestimated cost.

Ongoing Operational Expenditure (OPEX): Energy, Labor, Maintenance, and Wear Parts

OPEX is the recurring cost of running the equipment. Energy consumption is typically the largest OPEX component; industrial shredders are powerful machines with motors ranging from 100 to over 1000 horsepower. Labor costs include the time spent by operators feeding the machine and performing basic checks. A maintenance contract or in-house labor for scheduled services is another cost. Finally, a budget must be allocated for the periodic replacement of wear parts, primarily shredder knives and screens.

Financial Costs: Loan Interest, Leasing Fees, and Depreciation Considerations

If the equipment is financed through a loan, the interest payments over the term are a real cost of ownership. Leasing the machine involves monthly lease fees. From an accounting perspective, the shredder is a capital asset that must be depreciated over its useful life (e.g., 7-10 years). This non-cash expense affects the company's financial statements and tax liabilities.

Identifying Potential Hidden Costs: Training, Insurance, and Compliance

Less obvious costs must be factored in. Comprehensive operator training is essential for safety and efficiency. Adding a large piece of industrial equipment may increase the facility's property and liability insurance premiums. Lastly, ensuring the operation complies with local regulations for noise, dust, and emissions might require investing in additional dust suppression or containment systems.

Core Benefit 1: Drastic Reduction of Waste Disposal and Landfill Fees

For businesses generating substantial waste volumes, the immediate reduction in disposal costs is the most tangible and easily quantifiable financial return. Shredding directly attacks the volume and weight of waste that must be hauled away, leading to direct savings on every invoice.

Calculating Savings from Volume Reduction and Lower Disposal Fees

Shredding can reduce waste volume by 40% to 80%, depending on the material. The savings model is straightforward: [Current Monthly Waste Volume] x [% Volume Reduction] x [Cost per Unit Volume] = Monthly Savings. For example, if a company sends 100 cubic yards of waste to landfill at $50 per yard, and shredding reduces volume by 70%, monthly savings would be 100 x 0.70 x $50 = $3,500.

Additional Savings from Weight Reduction for Certain Waste Types

While many landfills charge by volume, some charge by weight. Shredding can also lead to weight reduction, particularly for wet waste, by releasing trapped water during the process. Furthermore, by separating heavy, inert materials from lighter fractions, the overall weight of residual waste destined for landfill can be significantly reduced.

Waste Stream Separation and Avoiding Hazardous Waste Surcharges

Mixed waste can be costly if it becomes contaminated. For instance, a small amount of oil or solvent can cause an entire load to be classified as hazardous waste, incurring disposal fees that are an order of magnitude higher. Shredding and subsequent separation help isolate these hazardous components, allowing the bulk of the waste to be disposed of at a much lower non-hazardous rate.

Logistical and Labor Cost Savings from Reduced Transport Frequency

Reducing waste volume means fewer pickups are required. If a company currently needs a dumpster emptied daily, shredding might reduce this to twice a week. This translates directly into lower fees from the waste hauler. It also reduces the internal labor time required for managing waste movements and coordinating pickups.

Core Benefit 2: Transforming Waste into Resources: Generating Recycling Revenue

Shredding is the key that unlocks the latent value trapped in waste streams. By liberating and preparing materials, shredding transforms a cost center (waste disposal) into a potential profit center (material sales), creating new revenue streams that directly offset processing costs.

Increasing Purity and Quality of Recyclables to Command Higher Market Prices

Shredding breaks apart composite materials, liberating individual components. Follow-on separation systems, like magnets and eddy current separators, can then effectively extract ferrous and non-ferrous metals. The homogenous output from a shredder allows for more efficient sorting of plastics, resulting in cleaner, higher-purity bales that fetch a premium price compared to mixed, unprocessed scrap.

Revenue Analysis from Producing RDF/SRF Fuel Pellets

For non-recyclable fractions, shredding creates a opportunity to produce Refuse-Derived Fuel (RDF) or Solid Recovered Fuel (SRF). This shredded, high-calorific-value material is a commodity that can be sold to cement kilns or power plants as a substitute for fossil fuels. The revenue generated from RDF sales can be a significant income stream, turning waste into a valuable energy resource.

Raw Material Procurement Savings from Closed-Loop Recycling

Manufacturers that generate plastic or cardboard waste can use a shredder to process their own post-industrial scrap and reintroduce it directly back into their production process. This closed-loop recycling reduces the need to purchase virgin raw materials, leading to substantial direct savings and insulating the company from volatile commodity markets.

Potential Environmental Benefits from Carbon Credits and Green Certification

Diverting waste from landfill and reducing greenhouse gas emissions can qualify a company for carbon credits, which can be sold on carbon markets. Furthermore, demonstrating a commitment to sustainable practices through shredding and recycling can enhance a company's brand image, lead to green certifications, and potentially attract environmentally conscious customers and investors.

Core Benefit 3: Enhancing Operational Efficiency and Risk Control

Beyond direct financial gains, shredding confers significant strategic advantages that, while harder to quantify, contribute to long-term operational resilience, safety, and competitive positioning. These benefits should be articulated in any comprehensive business case.

Optimizing Storage and Logistics: Reclaiming Valuable Space from Waste

Shredded waste is denser and more stable, allowing it to be stored and transported much more efficiently. This means a company can drastically reduce the footprint of its waste storage area, freeing up valuable floor space for productive uses like manufacturing or storage of finished goods. This represents a significant opportunity cost saving.

Improving Safety, Hygiene, and Corporate Image to Mitigate Management Risks

Loose, unprocessed waste can be a fire hazard, attract pests, and create unsanitary conditions. Shredding compacts the material, reducing fire risk by limiting oxygen availability. It also helps control odors and pests, leading to a safer and more pleasant work environment. This improved footprint enhances the company's image and reduces potential liability.

The Compliance Value of Secure Data Destruction

For industries that handle sensitive documents, products, or electronic data, shredding provides an irrefutable and compliant method of destruction. Ensuring that proprietary information or personal data cannot be reconstructed mitigates the enormous financial and reputational risks associated with a data breach, helping to comply with regulations like GDPR or HIPAA.

Enhancing Supply Chain Stability by Reducing Dependence on Third-Party Processors

Bringing shredding capability in-house gives a company direct control over its waste destiny. It reduces dependence on external waste management companies, whose pricing and availability can fluctuate. This control provides greater supply chain stability and negotiating power, ensuring waste is managed predictably and cost-effectively.

Building Your Financial Analysis Model: From Data Collection to ROI Calculation

Translating the identified costs and benefits into a dynamic financial model is the crucial step for objective decision-making. A well-structured model allows you to test scenarios, understand sensitivities, and present a data-driven argument for the investment.

Step 1: Gather Baseline Data: Current Disposal Costs and Waste Composition Analysis

Start with accurate current-state data. Collect at least 3-6 months of invoices from waste haulers to determine average monthly disposal costs and volumes. Conduct a waste audit to understand the composition of your waste stream—what percentages are cardboard, plastic, metal, wood, etc. This data is the foundation for all subsequent calculations.

Step 2: Define Key Assumptions and Variables: Reduction Rates, Recyclable Prices, Energy Costs

Populate the model with assumptions. Key variables include the expected volume reduction rate (e.g., 70%), the potential recovery rates for various recyclables, the current market price for those materials, and your local cost of electricity. It is prudent to use conservative estimates for material prices and optimistic estimates for costs to create a realistic projection.

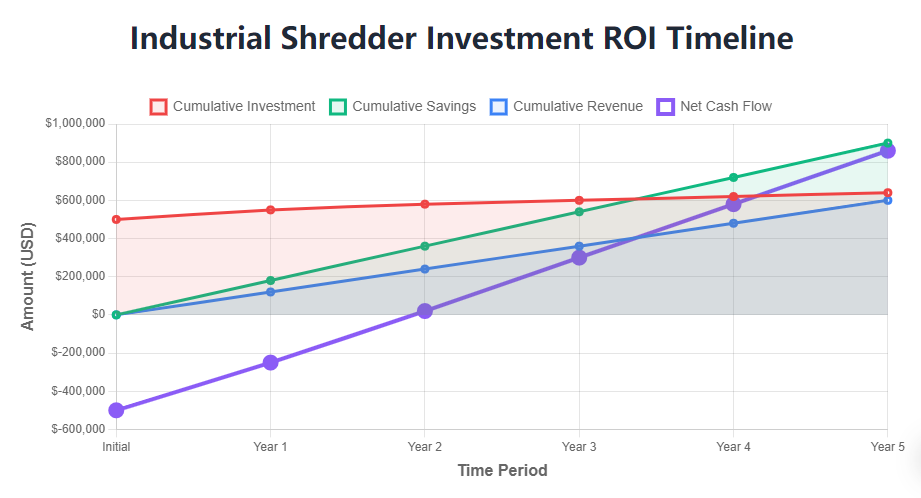

Step 3: Calculate Key Financial Metrics: Payback Period, Net Present Value (NPV), Internal Rate of Return (IRR)

Use the model to calculate standard investment metrics. The Payback Period is the time (in years) it takes for the cumulative savings to equal the initial investment. NPV calculates the present value of all future cash flows (savings - costs), indicating the project's absolute value. IRR is the discount rate that makes the NPV zero, representing the efficiency of the investment. A positive NPV and an IRR exceeding the company's hurdle rate indicate a good investment.

Step 4: Perform a Sensitivity Analysis to Identify Major Risks and Opportunities

Test the robustness of your model by performing a sensitivity analysis. Adjust key variables one at a time (e.g., "What if electricity prices increase by 20%?" or "What if the price for recycled plastic drops by 30%?") to see which factors have the greatest impact on the ROI. This identifies the biggest risks to the project's success and helps in developing mitigation strategies.

Step 5: Construct a Simple "ROI Calculator" Spreadsheet Template

Consolidate all this information into a user-friendly spreadsheet. A good template has input cells for all assumptions (CAPEX, OPEX, disposal fees, material prices) and automatically calculates outputs like monthly cash flow, payback period, and NPV. This becomes a powerful tool for internal discussion and for evaluating different equipment options from vendors.

Risk Considerations, Case Studies, and Final Decision Guidance

No capital investment is without risk. A thorough business case acknowledges these risks, provides strategies to mitigate them, and uses evidence from real-world applications to build confidence in the projection.

Mitigating Technical Risk: Strategies for Performance Guarantees and Material Testing

The risk that the shredder will not perform as expected with your specific material can be mitigated. Require vendors to provide a performance guarantee for throughput and power consumption. Insist on conducting a material test using a sample of your waste at their facility or an existing customer's site to see the results firsthand.

Managing Market Risk: Hedging Against Recyclable Material Price Volatility and Policy Changes

The revenue from selling recyclables is subject to market fluctuations. Use historical price data to model conservative, average prices in your financial analysis. Consider long-term offtake agreements with buyers to lock in prices. Stay informed about potential changes in government policy regarding landfill taxes or recycling mandates, which could impact the economic model.

Success Case Studies: Demonstrating Actual ROI from Different Industry Applications

Include anonymized examples. For instance: "A manufacturing plant invested $500,000 in a shredding system. They achieved monthly savings of $15,000 in disposal fees and generated $10,000 in new revenue from scrap metal and plastic sales, yielding a simple payback period of just over 24 months." Concrete examples make the proposal more credible.

Comprehensive Advice: Integrating Financial Analysis into a Final Investment Proposal

The final business case should tell a compelling story. It should start with the business problem (high disposal costs, missed recycling revenue), present the shredder as the solution, detail the financial analysis (TCO, ROI, payback), acknowledge and mitigate risks, and conclude with a clear recommendation for approval. Presenting both the quantitative and qualitative benefits creates a powerful argument for investment.