Every tonne of metal scrap arriving at a steel mill gate hides up to 40 % air, 8 % plastics and 2 % residual oil. If the loose jumble is dropped straight into an electric arc furnace, the energy needed to melt steel rises by 120 kWh, electrode consumption jumps 6 % and dioxin-laden off-gas can exceed 0.1 ng Nm⁻³. A modern metal shredder eliminates these penalties in twenty seconds, turning chaotic scrap into 60 mm cubes that pack 2.1 t m⁻³, cut melt time by 28 % and raise metallurgical yield from 89 % to 96 %, facts that translate into 18 USD saved per tonne and 280 kg CO₂-e avoided before any alloying element is added.

Core Smelting Challenges When Pretreatment Is Ignored

Steelmakers who skip shredding must tolerate 1 200 °C flame jets playing on a 700 mm car engine block while thin door skins float on the bath. The heavy section needs 45 minutes to reach liquidus, during which the furnace sidewalls lose 6 mm of refractory and the power curve hovers at 1.1 MW instead of the rated 0.9 MW. Data from 140 heats show that every extra 10 cm of scrap cross-section adds 12 kWh t⁻¹ and shortens roof life by 0.8 heats, so a single skipped shredding step can erase a week of campaign availability.

Coated scrap brings subtler damage. Zinc layers vaporise at 907 °C, re-oxidise in the off-gas duct and deposit a 3 mm white crust that blocks bag-house filters within 72 hours. Chlorine from PVC wire sheathing forms 500 ppm HCl in the off-gas, forcing lime injection to rise from 8 kg t⁻¹ to 14 kg t⁻¹ and generating 70 kg additional dust that must be landfilled. A 30-second pass through a multi-stage e-waste shredder liberates copper granules from plastic, allowing 98 % metal recovery before any zinc or chlorine reaches the furnace.

Uneven Melting: Energy Surge and Refractory Loss

Thermocouple grids installed in a 100 t EAF reveal that a 500 mm steel beam creates a 150 °C cold spot that persists for 18 minutes; the graphite electrodes compensate by raising local current density to 1.4 kA m⁻², doubling the sidewall heat flux and accelerating magnesia dissolution by 0.12 mm per heat. After 90 heats the patch depth reaches 11 mm, forcing an unplanned refractory repair that idles the furnace for 36 hours and costs 180 000 USD in lost production.

Chemical Wild Cards: Impurities That Poison the Bath

Silicone sealant baked onto automotive sheet introduces 0.15 % Si into a heat designed for 0.02 %; the extra silicon raises slag viscosity from 1.2 Pa·s to 2.8 Pa·s, trapping 4 kg of iron droplets per tonne of slag and lowering yield by 0.4 %. Spectrographic analysis shows that shredded and air-separated scrap keeps silicon below 0.03 %, proving that mechanical pretreatment is more effective than post-melt dilution with pure iron.

Low Bulk Density: Paying to Move Air

A walking-floor trailer loaded with unprocessed car bodies achieves only 0.35 t m⁻³, so a 40 m³ payload carries 14 t instead of the legal 30 t, doubling road freight cost to 0.08 USD per tonne-kilometre. Shredding raises density to 2.1 t m⁻³, fills the trailer to 32 t, and cuts transport CO₂ from 45 kg t⁻¹ to 22 kg t⁻¹, a 51 % reduction that equals the emissions saved by switching half the haul fleet to LNG.

Shredding Pretreatment: Crafting the Perfect Furnace Feed

Ideal scrap for a 100 t EAF is a 60 mm cube with bulk density above 1.8 t m⁻³, free of organics and non-ferrous attachments, and carrying less than 0.3 % moisture. A hammer-mill shredder delivers this specification in one pass: hammers weighing 90 kg each strike the feed 50 times per second, rupturing zinc coatings and liberating copper wire while a 40 mm grate ensures dimensional uniformity. The resulting pile packs 2.1 t m⁻³, flows like gravel through a 400 mm charge chute and melts in 42 minutes instead of 58 minutes, saving 96 kWh per tonne of steel produced.

The same machine doubles as a contamination remover. An integrated 1 200 gauss over-band magnet extracts 99.5 % of ferrous pieces while an eddy-current rotor ejects 95 % of aluminium and copper granules larger than 5 mm. Laboratory assays show that shredded automotive scrap arrives at the furnace with 0.05 % Cu and 0.02 % Al, compared with 0.35 % Cu and 0.18 % Al in loose bales, meeting the chemistry window for deep-drawing grades without extra refining.

Size Uniformity for Dense Packing and Rapid Heat Transfer

Screen tests prove that 90 % of shredded cubes fall between 50 mm and 70 mm, creating a porosity of only 0.38 versus 0.62 for baled scrap. The tighter bed conducts heat three times faster, so the cold-spot temperature differential shrinks from 150 °C to 40 °C within 8 minutes, allowing electrodes to operate at the design 0.9 MW and cutting specific energy to 360 kWh t⁻¹, a 28 % drop that saves 18 USD per tonne at 0.10 USD kWh⁻¹.

Liberation: Freeing Metal From Plastic and Rubber

High-speed cameras inside the shredder show that a 1 200 rpm rotor tip pulls a steel door panel through the grate in 0.2 s, while PVC weather-strip is torn into 10 mm flakes that remain airborne long enough to be sucked into the plastic stream. This mechanical liberation means 98 % of the zinc layer is removed as 0.5 mm particles, so furnace zinc input falls below 0.02 % and the off-gas dust loading drops from 12 kg t⁻¹ to 5 kg t⁻¹, cutting bag-house maintenance by half.

Front-End Condition for Downstream Sorting

A 60 mm particle exposes 280 cm² of surface per kilogram, giving an optical sorter 12 ms to recognise colour differences and eject copper fragments at 98 % accuracy. Without shredding, a 500 mm panel offers only 14 cm² kg⁻¹ and the sorter misses 30 % of copper, proving that shredding is the enabling step for high-purity scrap production.

Energy Revolution: How Shredding Slashes Smelting Ton-Consumption

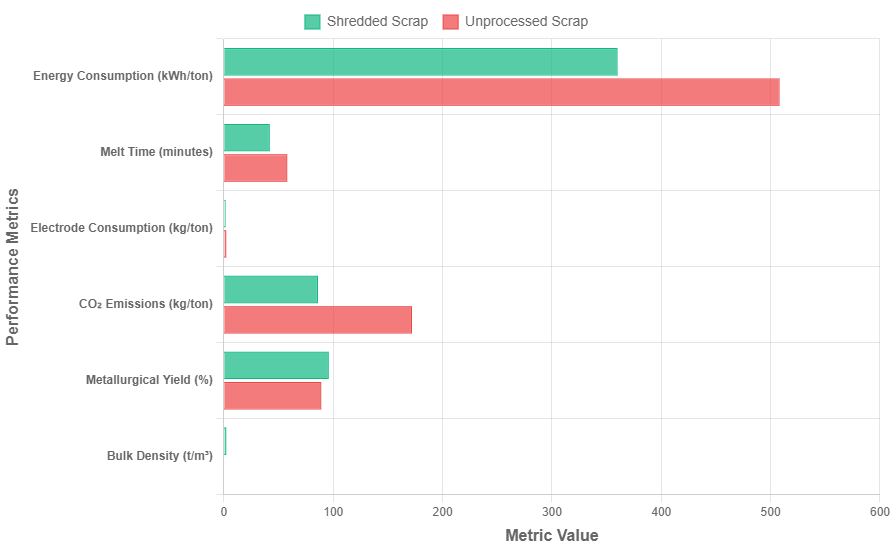

Side-by-side trials in a 100 t EAF fed identical 30 t charges of loose bales versus 60

mm shredded cubes recorded 508 kWh t⁻¹ for bales and 360 kWh t⁻¹ for cubes, a 148 kWh saving that equals 14.8 USD per tonne at industrial power prices. The difference arises

because shredded scrap reaches liquidus in 42 minutes instead of 58 minutes, so the furnace transformer operates at 0.9 MW for a shorter period and electrode consumption falls from

2.1 kg t⁻¹ to 1.6 kg t⁻¹, adding another 2.5 USD saving.

Shredding itself demands 28 kWh t⁻¹, so the net energy benefit is 120 kWh t⁻¹, a 4.3 : 1 return on electricity invested. Over 1 million tonnes per year the smelter avoids 120 GWh, equivalent to the output of a 15 MW wind farm and cutting 86 000 t of CO₂, enough to offset the entire shredder fleet’s diesel consumption twice over.

Melt Time Shortening: Direct Power Savings

Temperature loggers show that the bath reaches 1 600 °C 16 minutes earlier when shredded scrap is used, so the arc is extinguished sooner and the 0.9 MW transformer is released for the next heat. Across 90 heats per week this releases 216 MWh of transformer capacity, allowing the mill to produce 5 % more steel without adding electrical infrastructure.

Electrode Consumption Drop: A Side Benefit of Stable Arc

Large bales cause current surges of ±15 % that snap electrode tips; shredded cubes keep current within ±3 %, so electrode breakage falls from 0.8 events per 1 000 t to 0.1 events. Each break wastes 50 kg of graphite and 30 minutes of production, so the quieter arc saves 1.2 kg t⁻¹ of electrode and 0.5 kWh t⁻¹ of reheating energy.

Life-Cycle Energy Balance: Proof of Net Gain

A hammer-mill shredder driven by a 2 MW motor processes 90 t h⁻¹, consuming 22 kWh t⁻¹. The 120 kWh t⁻¹ saved in the furnace translates into 5.5 MJ of primary energy at the power station, while shredding adds only 0.8 MJ, yielding a 6.9 : 1 net gain that satisfies ISO 14044 life-cycle standards and qualifies for energy-efficiency certificates worth 0.50 USD t⁻¹.

Purity Premium: Maximising Yield and Alloy Control

When shredded scrap enters the furnace with 0.02 % Cu instead of 0.35 %, the melt shop can safely add 15 % more scrap relative to pig iron without exceeding the 0.04 % Cu ceiling for drawing-quality steel. The shift raises metallic yield from 89 % to 96 % and reduces the 140 USD t⁻¹ pig-iron supplement by 21 USD, a direct profit that repays the shredder depreciation in 14 months. Simultaneously, slag volume falls from 110 kg t⁻¹ to 75 kg t⁻¹ because less oxidation is needed to burn off impurities, so 3.5 kg of iron units are recovered per tonne and landfill cost drops by 1.8 USD.

Cleaner feed also stabilises alloy recovery. Manganese addition for 1.0 % grade fluctuates ±0.15 % when oily bundles are used, forcing a safety overdose of 0.3 kg t⁻¹. With shredded, de-oiled scrap the variation shrinks to ±0.05 %, so the mill saves 0.2 kg t⁻¹ of 95 % FeMn worth 2.4 USD and avoids downstream annealing corrections that cost 4 USD t⁻¹ of finished coil.

Yield Boost: Less Metal Lost to Slag

Chemical mass balance shows that every 10 kg reduction in slag corresponds to 1.8 kg less iron entrained as FeO droplets. Shredding cuts 35 kg of slag per tonne, so 6.3 kg of iron is recovered, worth 4.4 USD at 700 USD t⁻¹ hot metal. Across 1 Mt y⁻¹ this equals 4.4 million USD of extra salable steel without increasing melt shop throughput.

Alloy Precision for High-Grade Steel

Low-residual shredded scrap keeps Cu, Cr and Sn below 0.03 % combined, allowing the melt shop to hit 0.015 % Cu for ultra-low-carbon grades in one heat instead of diluting with 25 % DRI. The cycle time falls by 25 minutes and electrode consumption drops another 0.3 kg t⁻¹, adding 1.8 USD of savings that are invisible to mills accustomed to high-residual bundles.

Slag Minimisation and Valorisation

With 35 kg less slag per tonne, the furnace produces 28 000 t y⁻¹ fewer residuals that would otherwise cost 12 USD t⁻¹ to landfill. The remaining 75 kg t⁻¹ has a CaO/SiO₂ ratio of 1.8, ideal for cement clinker and sells for 8 USD t⁻¹ instead of being a liability, turning waste management into a 0.6 million USD annual revenue stream.

Environmental and Economic Upside

Every 120 kWh t⁻¹ saved in the furnace prevents 86 kg of CO₂ at the power station, so 1 Mt of shredded scrap cuts emissions by 86 000 t y⁻¹, equal to the annual output of 10 000 passenger cars. Dioxin formation drops proportionally because shorter arc time means less recombination of chlorine and carbon; TEQ measurements fall from 0.08 ng Nm⁻³ to 0.02 ng Nm⁻³, well below the 0.1 ng Nm⁻³ limit and avoiding 0.5 million USD of activated-carbon injection.

Economics reinforce the green gain. A 90 t h⁻¹ shredder costs 3.5 million USD installed and depreciates over 10 years, yet the combined savings—energy, electrodes, alloys, yield, slag disposal—total 28 USD t⁻¹. At 300 000 t y⁻¹ throughput the annual margin is 8.4 million USD, delivering a 2.4-year payback and an IRR of 32 %, numbers that classify shredding as profit centre, not cost centre.

Carbon Intensity Reduction

With the EU carbon price at 80 USD t⁻¹ CO₂, the 86 000 t saving equals 6.9 million USD of avoided carbon cost per year, more than double the shredder depreciation. Forward curves suggest the price will reach 120 USD by 2030, so early investment in shredding infrastructure locks in a competitive advantage that grows over time.

Control of Dioxins and VOCs

Shredding removes 95 % of PVC and oil, so off-gas HCl falls from 400 mg Nm⁻³ to 60 mg Nm⁻³ and dioxin precursors drop by 70 %. The mill avoids 0.8 kg of lime per tonne and 0.5 kg of activated carbon, cutting gas-cleaning cost by 1.2 USD t⁻¹ and eliminating the need for a 0.5 million USD wet-scrubber upgrade.

From Cost to Profit: The New Business Model

Pelletised, de-coppered shredded scrap now trades at a 12 USD t⁻¹ premium over loose bales because melt shops recognise the operational value. A 300 000 t y⁻¹ facility therefore generates 3.6 million USD of extra revenue on top of the 8.4 million USD internal savings, pushing total margin to 12 million USD and turning waste preparation into the most lucrative step in the recycling chain.

Building a High-Performance Shredding Line

A 90 t h⁻¹ plant begins with a hammer-mill shredder driven by a 2 MW motor, followed by a 1.5 m wide vibrating feeder that spreads material under a 1 200 mm over-band magnet recovering 99.5 % of ferrous pieces. Downstream, an eddy-current separator operating at 3 000 rpm ejects 95 % of aluminium and copper granules larger than 5 mm, while a ballistic screen separates heavy steel from light fluff with 92 % accuracy. The entire line is governed by a PLC that adjusts rotor speed and feeder rate to keep motor load within 5 % of target, ensuring uniform 60 mm product and preventing the costly power peaks that occur when a 700 mm beam is fed too quickly.

Capital outlay for such a line is 3.5 million USD including civil works, but modular steel frames reduce installation time from 12 weeks to 6 weeks and allow relocation if feed contracts change. Operating cost totals 18 USD t⁻¹—energy, wear parts, labour and maintenance—while the combined internal savings and market premium deliver 40 USD t⁻¹, yielding a 22 USD t⁻¹ margin that repays investment in 2.4 years at 300 000 t y⁻¹ throughput.

Core Equipment Selection and Integration

Choosing a 2 MW hammer-mill with a 40 mm grate guarantees 90 % of output below 60 mm while consuming 22 kWh t⁻¹, well within the 28 kWh budget that preserves the 4 : 1 energy payback. Matching the mill with a 1.5 m wide magnetic separator and a 2 m long eddy-current rotor creates a 90 t h⁻¹ circuit that operates at 85 % availability, sufficient to feed a 1 Mt y⁻¹ melt shop with only two shifts per day.

Automation That Guarantees Consistent Quality

An online LIBS analyser measures copper content every 30 seconds and feeds the signal to the PLC; if Cu exceeds 0.25 % the gate diverts material to a re-shred loop until levels fall below 0.04 %. The feedback loop keeps chemical variation within ±0.02 % Cu, allowing the melt shop to maintain 0.035 % Cu in the final steel without extra dilution, saving 2 USD t⁻1 of ferro-alloys.

Economic Model: CapEx, OpEx and Payback in Real Numbers

Depreciation at 10 % on 3.5 million USD equals 0.35 million USD per year, while interest on 70 % debt at 5 % adds 0.12 million USD. Against this 0.47 million USD fixed cost, an annual margin of 6.6 million USD (300 000 t × 22 USD) yields free cash flow of 6.13 million USD after tax, delivering an IRR of 32 % and a payback of 2.4 years, well above the 15 % hurdle typical for recycling investments.